Flawed Capital Management: Fundraising is not Strategically Timed to a value-enhancing milestone

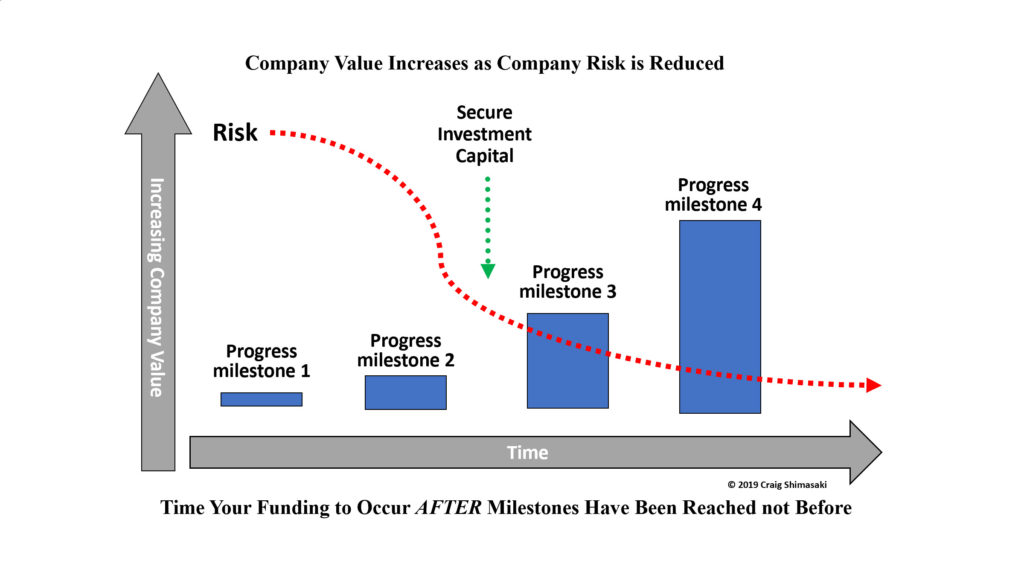

An unintentional but common mistake of an entrepreneur is that their capital raises are not timed to occur after reaching a value-enhancing milestone. Less experienced entrepreneurs raise capital when they need it. If a company attempts to raise capital because they are close to running out of money, but they have not reached a value-enhancing milestone, this negatively impacts investor interest and the company valuation. A value-enhancing milestone is an accomplishment that increases the valuation of the company because by accomplishing this, the risk of product development failure has been reduced.

Many entrepreneurs instinctively focus on raising money only when they need it or just prior to running out of cash. An important strategy for success is determining the amount of capital to raise, and the timing in which to raise it. You should always plan that the amount of capital you raise will allow you to reach certain milestones, however, it is not just the amount of money raised that is important, but also the timing of raising money.

When a company sets out to raise money but has not reached the next value-enhancing milestone, it becomes more difficult to raise money for three reasons, 1) It is not clear to investors what you will accomplish with their new money, as the company has not increased its value since the last round 2) There is a perception that the company is desperate because you are raising money out of need rather than in strength 3) There is a perception that the entrepreneur leader is not capable of properly managing funds for the company.

How to Avoid this Mistake

Identify your value-enhancing product development milestones, then time your funding closings to occur after completing a key milestone. This means that you must identify and estimate the amount of capital needed to reach each value-enhancing milestone. Begin raising capital 9 months, to as long as 18 months prior to needing the capital, depending on the size of the round it can take this long to close on a large financing. For capital raises that are $0.5MM or less, the timeframe usually is shorter, as the investors for seed funding are typically angels rather than institutional investors.

Ample time is required to make connections, give pitches, allow investors to complete due diligence, negotiation of terms, legal documents and then the final funding. One way to help shorten this timeframe is to always be “selling” even between financing. Practically speaking, you should always be in a mode of “raising money” whether you need it or not, as you can always say “no” but you cannot say “yes” without an offer. In a sense, you should always be raising money. By timing your closing to occur after completing key milestones, you will improve your ability to raise the needed funds.

To preserve capital and direct the majority of it towards product development, remember to stay as virtual as possible and focus on your core activities and outsource the things that others can do better than you, such as non-core activities. One cash preserving option during your early stages is to consider negotiating a lease agreement with the university for lab space and equipment (if you licensed their IP), and even lease some of their key personnel who worked on the licensed technology. Also consider compensating critical individuals and consultants with some equity for reduced fees.

The key is to efficiently utilize the limited capital you have, and to raise new money on strength to improve your likelihood of success. Remember that without a continuous source of capital, regardless of how great your technology, you will never be able to reach your goal.