or…“How to persuade individuals who have money—to share some with you”

Continuous Flow of Capital is Vital

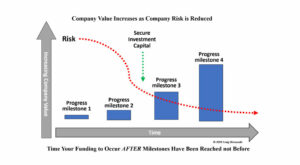

Few issues are more important to start-up and development-stage biotechnology companies than maintaining a continuous flow of capital—if you hope to advance the development of your product and market in an uninterrupted manner. The amount of capital you raise, and your company’s development stage, will dictate the type of investors who are attracted to your enterprise.

Few issues are more important to start-up and development-stage biotechnology companies than maintaining a continuous flow of capital—if you hope to advance the development of your product and market in an uninterrupted manner. The amount of capital you raise, and your company’s development stage, will dictate the type of investors who are attracted to your enterprise.

A critical tool for all biotech entrepreneurs is an Investor Slide Deck or “Pitch” Deck. This is typically a collection of PowerPoint slides used for communicating your deal to different groups of investors. Since capital is the lifeblood of your company, having a well-thought-out Pitch Deck is a vital asset for all biotech entrepreneurs. To address this I have put together some basic information about what a biotech investor pitch deck should contain when presenting for the first time to a group of potential investors.

Creating a biotechnology product is vastly different from other industry products, therefore, the topics that biotech investors want to hear about also differ. Unlike IT products and other technology products, biotech products have longer development timeframes, more exorbitant development costs, much more stringent regulatory requirements, and a unique need for diversely-skilled individuals. Therefore, one cannot use a generalized entrepreneurial pitch deck when pitching to biotechnology investors, however, there are some key topics that remain universal. Gratefully, biotech products are also unique in their significance to society and in the type of returns possible for investors.

The Pitch Deck

The outline below and the accompanying PowerPoint Investor Pitch Deck example are provided to help those who need guidance on what topics and information are important for a biotech investor presentation. Realize that this is not a template per se in which to simply fill in the blanks, but an ordered list of topics that are significant to most all biotechnology investors.

In reality, you should always tailor your slide deck to the particular audience and their interests; whereas the number of slides and the depth of information surrounding any particular topic are dictated by the time allocated for that meeting. However, in an attempt to provide a basic and universal outline for preparing a biotech investor pitch deck, this will give you a starting point.

16 Topics to Cover: Basics of an Investor Pitch Deck for Biotech Entrepreneurs

This is my preferred slide order when “telling the story”. I find that this order makes sense to the listener and is easy to follow as it builds upon preceding information. There are different opinions on which topics to cover and their sequence order. For example, some suggest that the Leadership Team be presented at the beginning rather than toward the end of a presentation. My opinion is that unless you have a stellar and complete Dream Team, then first sell the audience on the opportunity and the novelty of the idea. Whatever your topic order, make sure you tell a story that unfolds logically and be sure that the information is relevant to the investor audience you are pitching.

Above all, do not present a hapha zard mosaic of subjects in an illogical sequence that confuses your listening audience. For instance, don’t start talking about your technology and product benefits before you first explain the significance of the “problem” or “pain” as it relates to your target market. Although some listening individuals may already be familiar with the problem you are addressing, not everyone will. And certainly everyone will not be aware of the nuances of this problem, yet these issues could be key to appreciating your product’s value proposition.

zard mosaic of subjects in an illogical sequence that confuses your listening audience. For instance, don’t start talking about your technology and product benefits before you first explain the significance of the “problem” or “pain” as it relates to your target market. Although some listening individuals may already be familiar with the problem you are addressing, not everyone will. And certainly everyone will not be aware of the nuances of this problem, yet these issues could be key to appreciating your product’s value proposition.

It is always important to remember that the majority of biotech investors are driven by “data”. Therefore present reproducible data on the technology, share data supporting your market need, describe data supporting insurance reimbursement for your product, include data when available on all other topics discussed, and don’t forget to cite credible sources.

Slide Deck Topic Order

1. Company, Purpose, Mission and History (relevant information only)

* Describe the focus and purpose of the company

* Tell where the technology originated, if significant

* Describe the current stage of development (Start-up company or Phase 1 clinical trials)

* Tell why you are there, and share the “Ask”— how much money are you raising? (Example: Seeking $1.5MM in Convertible Notes)

2. Problem or “Pain” – Explained in a way that lets the investors feel or know the pain of the problem

* Describe the issues with the current status quo (problem with diagnosis, treatment, manufacture, etc)

* Help the investors understand the problems those suffering with this condition face, or the issues someone has to deal with in this situation (describe in terms of limitations, costs, inconveniences, ineffectiveness, etc)

* Discuss why is there a problem

3. Technology and Product Solution

* Describe how your product or technology solves this big problem

* Show data, results, prototype testing and evidence that the technology or product works or will work, or has a very high likelihood of success

* Demonstrate to the audience that your data supports the likelihood of product success, or show its significance in leading to product success

* Describe the mechanism-of-action (non-confidential version), how it works (if you know). You don’t need to reveal trade secrets or confidential information here

4. Competition and Substitutes Currently Used

* Summarize the competitors and list any products or substitutes

* Describe products that may be coming out in the future and from whom

* Discuss the willingness of users to change from the current status quo

* Elaborate on your product’s points-of-differentiation and discuss the significance of your advantages

* Address why no one fixed this problem yet

5. Market Opportunity and Strategy

* Estimate the market size and be prepared to describe how it is calculated or provide sources (use credible sources only)

* Tell who is your Target Market and who is your secondary market – describe how you will reach your customers

* The amount of detail here depends on the biotech sector and the condition/disease/industry you are targeting (some market sizes are well-understood)

* Explain why the timing is right for your product

6. Business or Revenue Model

* Show how you are going to make money

* Describe the partnerships that are needed in order to be successful

* Discuss any distribution channels needed and the status of these relationships

7. Reimbursement Strategy

* Show proof of reimbursement that is related to your product or provide supportive comparisons

* Describe your pricing model if applicable

* Show any pharmacoeconomic models or data to support the type and amount of reimbursement for your product

8. Product Development and Regulatory Pathway

* Describe your current product development status and the progress made to date

* List your next product development milestones and the estimated timeframe to reach these

* Describe your regulatory route, timing, and issues you face and how they will be mitigated

* Briefly discuss any potential follow-on products supported by this technology

9. Intellectual Property and Secret Sauce

* Share what patents are filed or issued and indicate whether or not you have trade secrets

* If available, discuss findings from your Freedom to Operate opinion

* Share your technology license terms, royalties and milestone fees (if any)

10. The Leadership Team

* Discuss your senior management team and their relevant experience and their past successes

* Describe the background of your Advisors/Consultants/Board Members if formed

* Candidly discuss whether or not your team is complete and who else is needed and with what backgrounds

* Describe any key partnerships formed or those in progress

11. Estimated Exit, Potential Acquirers and Timeframe

* Share your presumed exit – VCs will know this but it is helpful if they know you know, and most Angel investors want to hear this

* Briefly share data on exit valuation or exit revenue multiples for your sector

* It is not wise at this stage to share your opinion on a “pre-money valuation” for your company as this will be based in part upon investor interest, and is negotiable. Preconceived opinions at this point may limit investor interest.

12. Financials

* Ideally, provide a five-year Pro Forma projection of future revenue (if relevant – generally not needed for therapeutics), share your assumptions and be sure to build with “bottom-up” rather than “top-down” calculations

* Describe the total funds raised to date, and what these funds were used to accomplish, describe grant funding if awarded

* Share your estimates for future funding needs to reach commercialization, and estimate the number of additional financing rounds

* Show your generalized Use-of-Proceeds for this fund raise

13. Risks and How They Will be Mitigated

* This slide is not always necessary, but risk mitigation issues must be addressed during the presentation or during the Q&A

* Alternatively, risk mitigation information can be incorporated within each topic as it is addressed or they can be placed in the summary slide depending on the investor audience and time allotted

* Investors know that you cannot manage a risk that you have not identified

14. Summary

* Recap any key highlights relevant to this audience and include any points you want them to remember

15. Thank You/Question & Answer Time

* Thank the audience (this does not necessarily have to be a slide, but be sure to acknowledge your appreciation for this opportunity and for any particular efforts made for you to speak to this audience

* Q&A typically starts here. However, be aware that some investor groups do not wait for the last slide to ask all their questions

* A good sign of potential interest is when investors ask many questions and become very engaged after your presentation

* Investors who have made up their mind not to invest, typically do not have many questions

16. Support Slides

* These slides are kept in reserve and are selected and shown based upon questions asked by investors

* The number and content of these slides are your choosing. Be prepared with additional and more detailed information on any topics you anticipate this investor audience may ask

How Many Slides do I Need?

Although the topics I have described are numbered, they do not represent the total number of slides needed, sometimes it can be more or less. The exact number of slides you use will depend on the following:

* The time allotted for the investor presentation (leaving time for Q&A)

* The backgrounds of the investor audience

* Their key issues with the product, technology, market or the business model

* Which issues are relevant to your technology and product success

Just be sure to cover or touch on each listed topic to a lessor or greater degree, as all are significant to an investor. Some of these topics can be combined, depending on your sector and product technology. However, the depth of you discussion on any topic will depend on the issues surrounding that topic. For instance, if every predecessor product in your sector has previously failed somewhere in the regulatory process, you will need to spend more time explaining why yours is different and has a higher likelihood of success.

A good rule of thumb for determining the number of slides in your pitch deck, is to presume that you need 1-2 minutes per slide, minus the time set aside for Q&A. For instance, if you are allocated 30 minutes for an investor presentation, plan on about 15-20 minutes for your slide presentation which would be no more than 15 slides, then allocate 10-15 minutes for Q&A afterwards. You can always elaborate in more detail if fewer questions are asked. However, you do not want to be cut off before finishing your presentation because you ran out of time.

In this blog I principally address the “content” and the subject matter of a good biotech investor presentation. I have not dealt with the issues related to slide formatting and presentation etiquette, since there is abundant publicly available information about these subjects. Just be sure to incorporate visual aids when discussing complex technology and make use of graphs and figures when explaining concepts rather than simply using only text.

For those wanting more information about presentations and creating a business plan, read Chapter 22 titled “Your Business Plan and Presentation: Articulating Your Journey to Commercialization” in my latest book “Biotechnology Entrepreneurship: Starting, Managing and Leading Biotech Companies.”

What Investors are Looking For That is Not in Your Slides

It is important to understand that not everything an investor is looking for is contained within your slides. I have listed a few of the characteristics investors look for in a biotechnology entrepreneur during this face-to-face meeting. These “unspoken” characteristics are observed and identified throughout your presentation and more importantly, during the Q&A session after your presentation. These are not necessarily qualities you can “practice” for a presentation, although all individuals can improve on them if they desire. Rather, these are inherent characteristics within an individual. When presenting, you want to be yourself and be comfortable, rather than “perform” in a manner that you think an investor wants to see and hear. I would advise that you assess these character qualities within yourself before you begin raising capital. A good way to do that is to ask individuals close to you if they can observe any of these characteristics within you.

It is important to understand that not everything an investor is looking for is contained within your slides. I have listed a few of the characteristics investors look for in a biotechnology entrepreneur during this face-to-face meeting. These “unspoken” characteristics are observed and identified throughout your presentation and more importantly, during the Q&A session after your presentation. These are not necessarily qualities you can “practice” for a presentation, although all individuals can improve on them if they desire. Rather, these are inherent characteristics within an individual. When presenting, you want to be yourself and be comfortable, rather than “perform” in a manner that you think an investor wants to see and hear. I would advise that you assess these character qualities within yourself before you begin raising capital. A good way to do that is to ask individuals close to you if they can observe any of these characteristics within you.

Important Entrepreneurial Characteristics That Are Not Contained in Your Slides

* Passion for your work

* Enthusiasm

* Intricate and working knowledge of your business, product and market

* Good strategic thinking

* Ability to inspire others and ability to execute

* Willingness to receive advice, listen and learn

* Leadership characteristics

* Culture fit

The Takeaway Tidbit

Maintaining a continuous and steady stream of capital is critical for all development-stage biotechnology companies wanting to become successful. Since capital comes from investors, the biotech entrepreneur must be able to skillfully convey relevant information supporting an investment decision in their company. In order to do this one must know the pertinent issues for any investor. It is an unfortunate situation when a biotech entrepreneur has a great product opportunity, yet they derail the investment process because they do not understand how or what to communicate to sophisticated investors.

Maintaining a continuous and steady stream of capital is critical for all development-stage biotechnology companies wanting to become successful. Since capital comes from investors, the biotech entrepreneur must be able to skillfully convey relevant information supporting an investment decision in their company. In order to do this one must know the pertinent issues for any investor. It is an unfortunate situation when a biotech entrepreneur has a great product opportunity, yet they derail the investment process because they do not understand how or what to communicate to sophisticated investors.

Biotech entrepreneurs should start by developing a well-thought-out pitch deck addressing these basic topics. You can later modify the depth and detail of information according to any investor interest or the issues relevant to their concern about your organization and product technology or market. By possessing a solid pitch deck covering each of these relevant topics, a biotech entrepreneur will have a tool to communicate to investors the relevant information necessary for making investment decisions. By first creating a thorough and well-developed Investor pitch deck, you can later selectively modify or consolidate this information into any presentation length and adapt it for other investor audiences, and thereby have at your hand, a ready tool to raise capital for your company.

Copyright 2015 © BioSource Consulting. All Rights Reserved